Managing finances can be a daunting task, especially for small businesses and freelancers. Fortunately, there are several user-friendly accounting software options that can help you streamline your financial processes, from invoicing to expense tracking. Here are five easy-to-use accounting software recommendations to simplify your financial management.

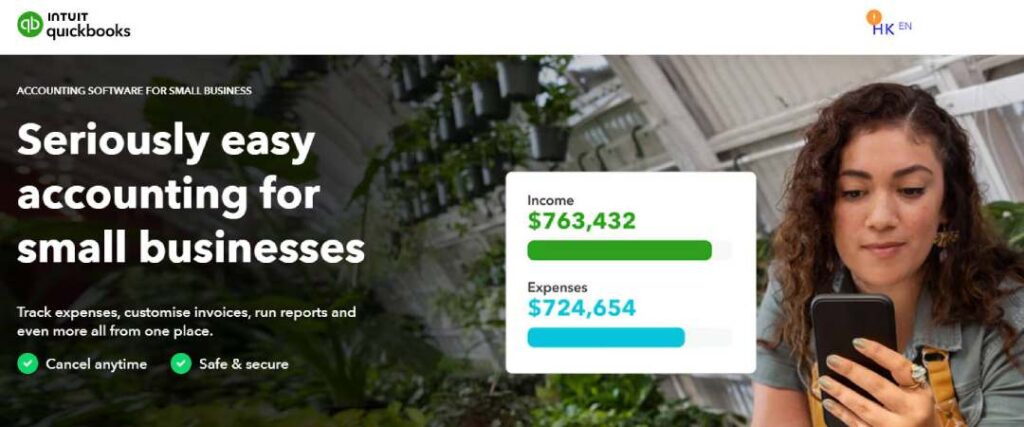

1. QuickBooks Online

Overview: QuickBooks Online is one of the most popular accounting software solutions, especially for small businesses. It offers a wide range of features, including invoicing, expense tracking, and payroll management, all within an easy-to-navigate interface.

Key Features:

- Automatic expense tracking and categorization

- Customizable invoices and payment tracking

- Real-time financial reporting and dashboards

- Integration with bank accounts and other financial apps

Why It’s Easy to Use: QuickBooks Online provides intuitive navigation and automation features, making it simple for users to manage their finances without needing extensive accounting knowledge.

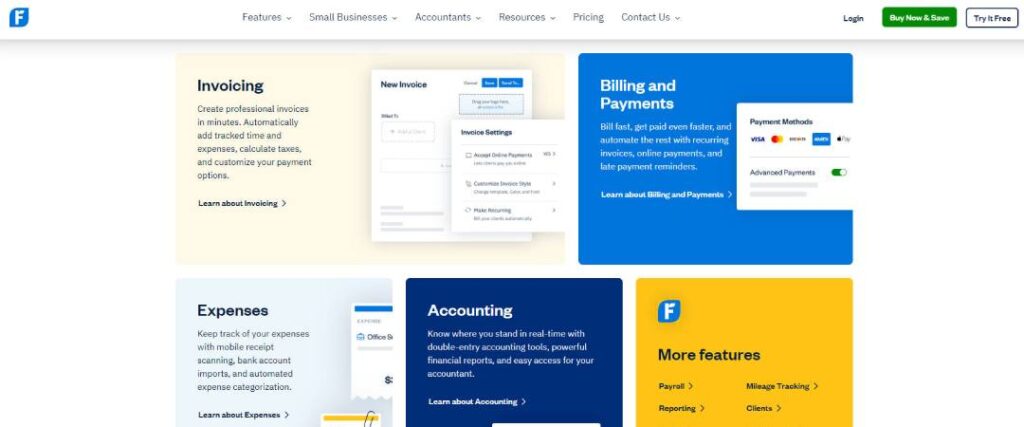

2. FreshBooks

Overview: FreshBooks is a cloud-based accounting software designed with freelancers and small business owners in mind. It focuses on simplicity and ease of use, offering tools for invoicing, time tracking, and expense management.

Key Features:

- Professional-looking invoices with customizable templates

- Time tracking for billing clients accurately

- Expense tracking with receipt capture via mobile app

- Automated reminders and late fee options for overdue invoices

Why It’s Easy to Use: FreshBooks’ clean, user-friendly interface makes it easy to manage invoices, track time, and handle expenses, all from one platform.

3. Xero

Overview: Xero is a powerful yet straightforward accounting software that’s perfect for small businesses. It offers a wide range of features, including bank reconciliation, invoicing, and payroll, with a focus on automation and integration.

Key Features:

- Bank reconciliation with automated transaction matching

- Online invoicing with real-time updates on payment status

- Comprehensive dashboard with real-time financial insights

- Integration with over 800 third-party apps

Why It’s Easy to Use: Xero’s simple interface and automation tools reduce the time spent on manual data entry, making it easier to stay on top of your finances.

4. Wave

Overview: Wave is a free accounting software solution that’s ideal for small businesses, freelancers, and consultants. It offers essential features like invoicing, expense tracking, and financial reporting without any cost.

Key Features:

- Free invoicing with customizable templates and payment tracking

- Expense tracking with receipt scanning via mobile app

- Accounting features like bank reconciliation and financial reporting

- Payroll and payment processing available as paid add-ons

Why It’s Easy to Use: Wave’s user-friendly design and free access to core accounting features make it an excellent choice for those on a budget who need a simple solution.

5. Zoho Books

Overview: Zoho Books is part of the Zoho suite of business applications, offering comprehensive accounting features in an easy-to-use platform. It’s designed for small to medium-sized businesses looking for a streamlined financial management tool.

Key Features:

- Automated bank feeds and transaction matching

- Customizable invoices with automated reminders

- Integrated inventory management for product-based businesses

- Multi-currency support for global transactions

Why It’s Easy to Use: Zoho Books offers a clean interface and seamless integration with other Zoho apps, making it easy to manage all aspects of your business finances in one place.